The Effect of AI and Machine Learning on the Office of the CFO

The dynamic world of accounting and finance is undergoing a significant transformation driven by artificial

Build business applications with no coding knowledge

Save time & say goodbye to manual, repetitive tasks

Standardise & automate your business processes

Remove repetitive tasks from your team’s to-do list with UniFi Automation software

Automate accounting processes with ease

Centralise data from multiple systems via API

Retrieve, visualise, analyse & report on data

Cloud-based work OS for desktop & mobile

Attach documents to workflows & automate distribution

Two-way Excel integration reduces manual data re-keying

Full users get access to all current & new applications

ML services can be easily added to your applications, allowing you to benefit from Artificial Intelligence

Easily apply AI services to any field in your applications to imitate human behaviour

Find out about our vision, mission and core values, as well as the history of UniFi.

A step-by-step guide to using UniFi.

Read our latest blogs, news and updates.

Learn about the 3 different ways you can implement UniFi.

Apply to work with us or register you interest

Want to sell UniFi? See your options.

Find out how our customers have benefited from UniFi.

Join the UniFi mailing so you can get more out of your teams, time, and tasks.

Get empowered to make the most of UniFi.

Our helpful Support Team is available to assist you via phone and email.

Free SaaS business guides made with over 25 years’ experience.

See some of the companies using UniFi.

The dynamic world of accounting and finance is undergoing a significant transformation driven by artificial

The UK government has taken a step towards promoting the adoption of artificial intelligence (AI)

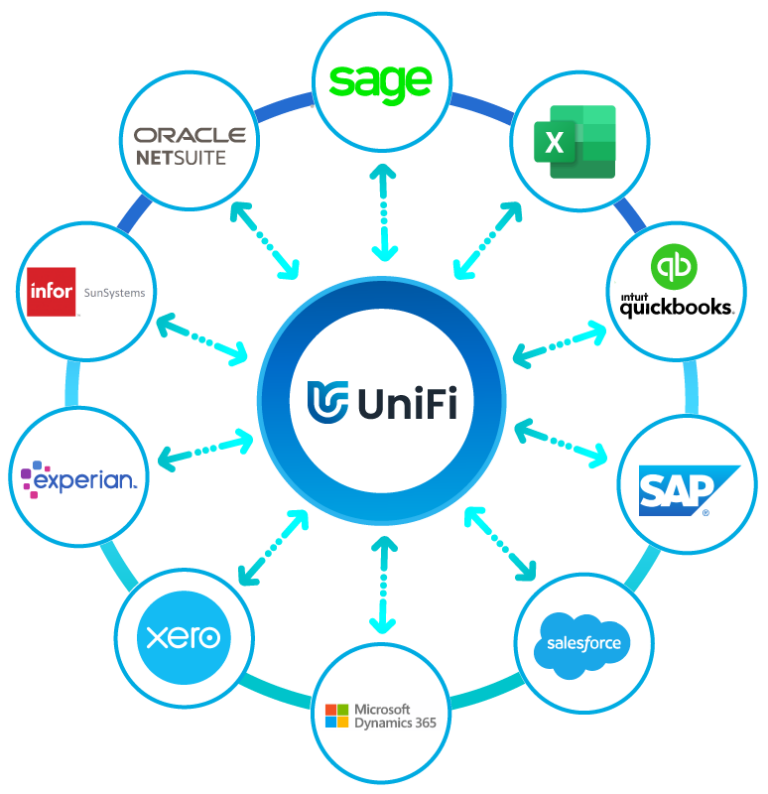

UniFi has powerful integration capabilities including advanced API’s.

The UniFi Data Connectors allow you to connect to 3rd party applications via our ‘Application Programming Interface’ (API).

This means you can retrieve data for use on a form either to populate an external dropdown (e.g., a list of suppliers, customers etc.) or to put data into an external calculated field (e.g., retrieve a budget or forecast figure).

Data connectors are created and edited in the ‘Data Connector’ section of UniFi and comes included as a standard feature in UniFi.

UniFi comes with a flexible data connector builder that allows you to connect to popular accounting, Enterprise Resource Planning, CRM, HR and other business systems. It can look at a process and automatically create a journal and post it into your accounting system.

This helps you unleash the full potential of your tech stack with a wide spectrum of pre-built integration capabilities.

Not only can you push or pull data from different systems, but you can also use the middleware to convert data into a different format. For example converting XML2 to JSON.

Are you currently connecting to SunSystems API using a third-party application?

If so, it’s likely that you are connected to SunSystems using its underlying database. With the launch of SunSystems cloud, all direct database connections will close, which means your third-party application may no longer be able to connect to SunSystems.

Your third-party application may have to be re-developed to connect to SunSystems API as opposed to direct database access.

The good news is that UniFi has been written from the ground up to connect to SunSystems using best practice, with a secure and future proofed API integration.

UniFi always uses the official API for each product to ensure continual support and operations.

Not a techie ?

UniFi comes with a powerful API tool that will make your life easier.

What is an API?

Simply put, an API (Application Programming Interface) is an interface allowing different pieces of software to communicate with each other. It does this seamlessly in real-time, so data is always accurate and up to date.

Some familiarity with making API calls is helpful in order to build connectors, but examples are available as part of the set of Foundation Apps that comes with UniFi. So less technical users may find using these as a starting point helpful.

Below is the result of an integration process. In this example, we have automated the uploading of exchange rates by extracting them from a source system and sending them directly into SunSystems.

API Information for techies

UniFi has a powerful API that allows a wide variety of actions to be automated. This includes :

You can use the API to integrate your application with UniFi for seamless data transfer.

UniFi API uses JavaScript Object Notation (JSON) to receive data and respond to requests. JSON is a commonly used data-interchange format that is also easy for humans to read and write.

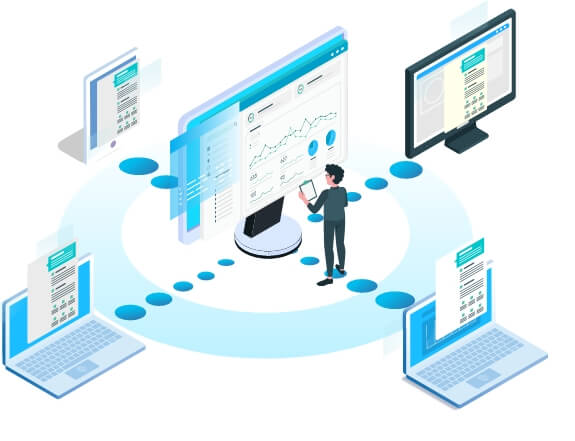

Single source of truth

UniFi integrates with any system using the data connector tool. This middleware will enable you to automate data exports from other business systems into UniFi, providing one unified view, to give you a single source of truth. This will provide real-time data to improve the timeliness and accuracy of your organisation’s decisions.

You can view the data as-is using ‘Quick Reports’ or using the sophisticated Business Intelligence tool that’s included, to create more complex reports that you can drill down into using data within UniFi and/or data held in any other systems.

Say goodbye to operational silos

Your organisation likely uses multiple systems that specialise in one business function – finance, production, sales, operations etc.

However, your actual business processes span across multiple departments.

For example, if you create a new customer in the sales department using the CRM system and want that customer to be synchronised across all the other systems in your organisation including the finance system, UniFi can seamlessly replicate that customer across all other systems.

If the customer’s data is updated in the sales system, the changes will automatically be updated in the other systems without any manual intervention.

This way, you don’t have to worry about repetitive keying of information.

With UniFi middleware, you can save time and eliminate any errors that you’d normally experience working manually.

Optical Character Recognition and AI Engine

FinanSysApps comes with an innovative OCR and AI engine that can be used to automatically extract data from invoices, receipts, and other financial documents. This data can then be used to populate fields in FinanSys Apps, eliminating the need for manual data entry.

Enter your details below to get a free demonstration of UniFi and see how you can automate and streamline your processes.

Privacy Policy : We hate spam and promise to keep your email address safe